Back

How good is the tech, really?

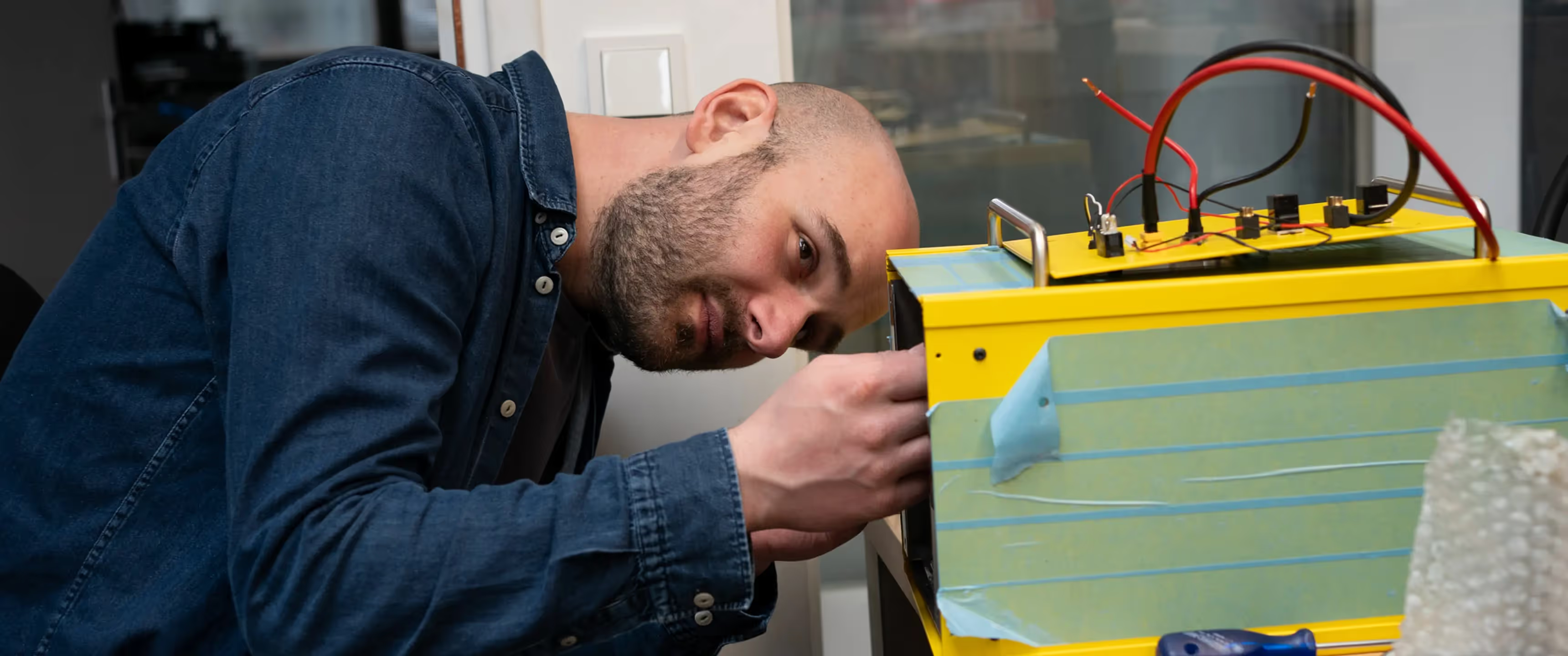

The founders working day and night, in love with their technical challenge. Powered by the potential energy of their dreams: exponential growth models and billion dollar exits. But who will perform the reality check?

The start-up is without turnover and always hungry for money. Selling the story is a core competence of every successful start-up. Pitches are honed and perfected every time investors are present. With sheer optimism, VC’s are lured into the dream. It is that strong belief and persuasiveness that will make the difference between failure and success, as any investor knows.

Although eager to take the bait, investors are patient and will hold on to their money until the due diligence report comes in. First, venture consultants will crunch the numbers of business potential and market validation. Then, assess the founder’s entrepreneurial weight. Many investors would stop here, but I believe this is a mistake. They should get one more answer before they spend their money: How good is this tech, really?

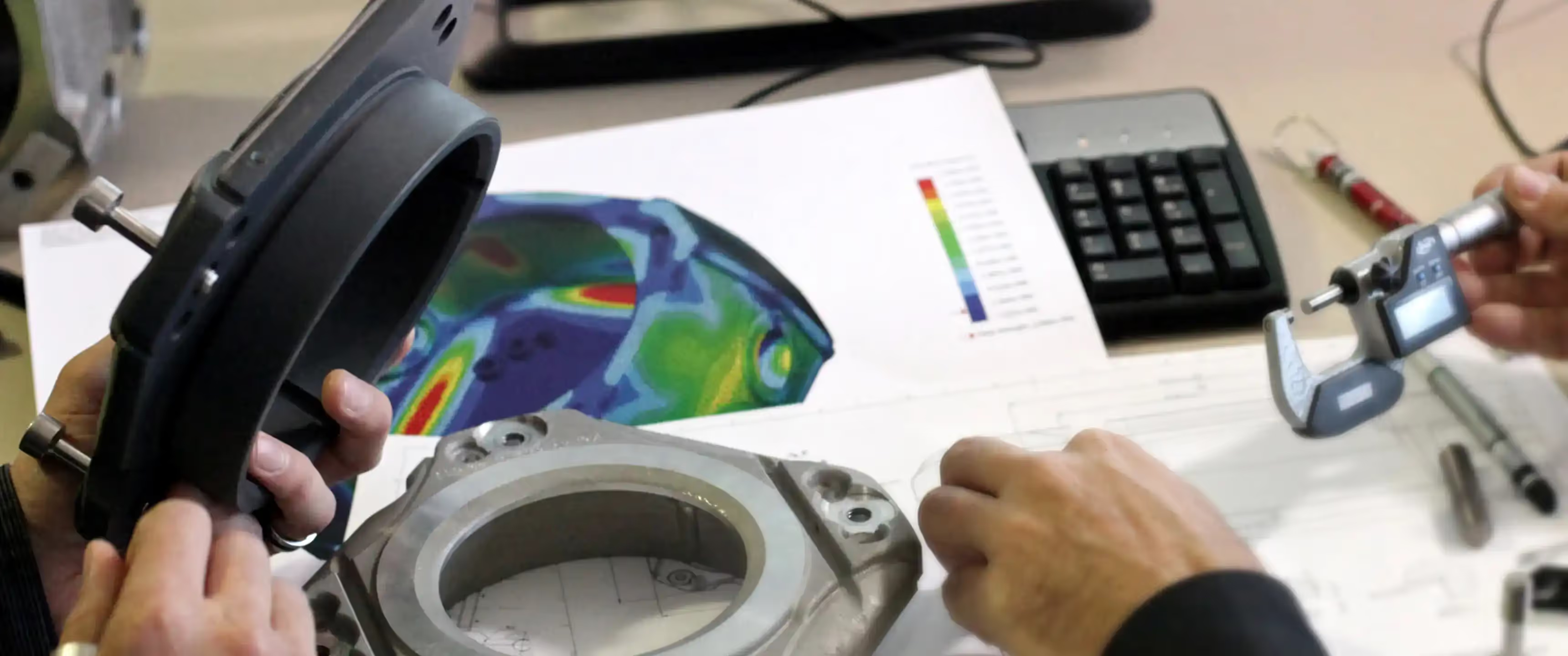

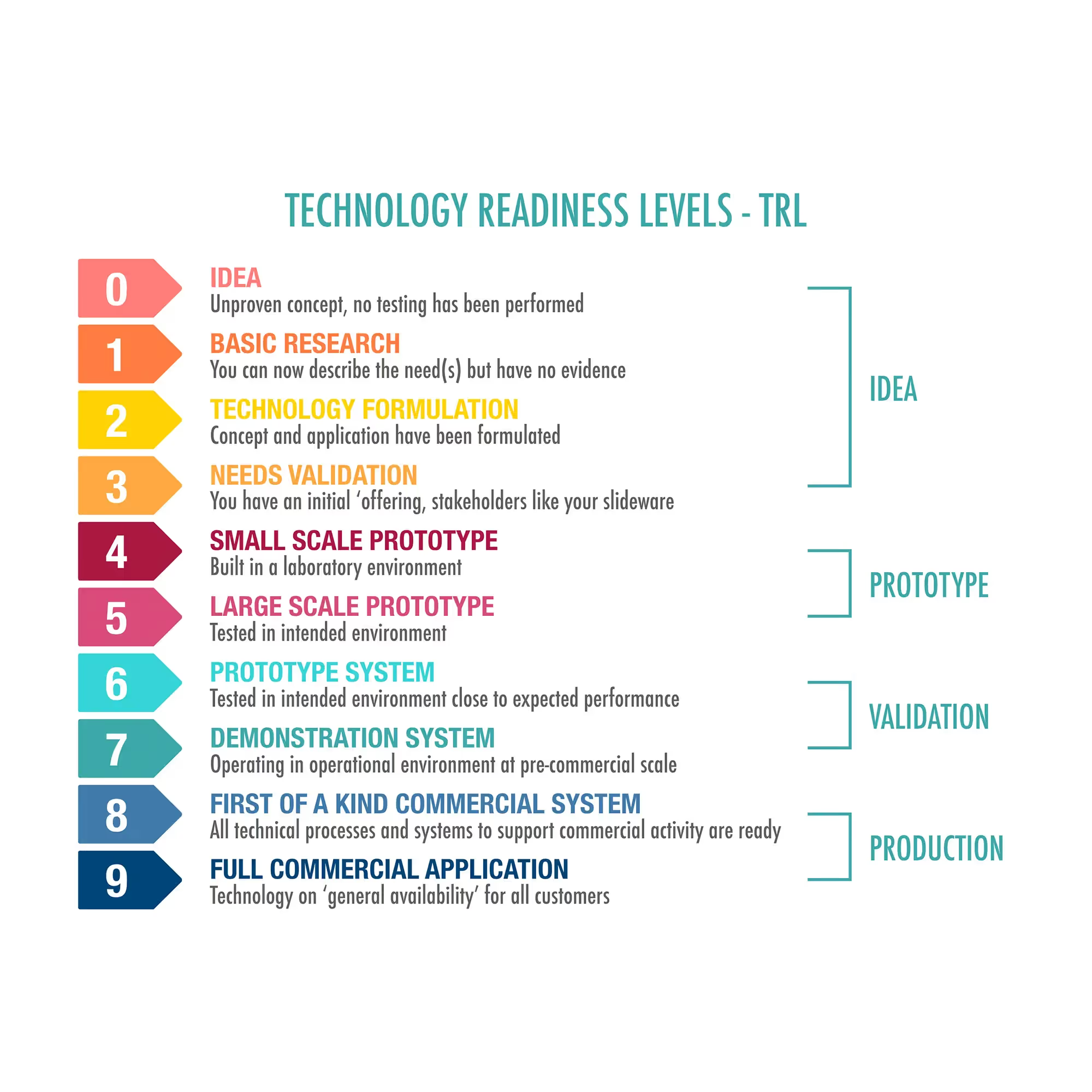

What of the offered technology is actually proven to work and what is still a dream? How feasible are the features that are not yet proven? What will it take to get from a TRL 4 to a 7 or 8? And how unique and protected is this technology? There are many more questions that should be answered and will provide much more insight in where an innovation or a tech startup is and how many hurdles there still are between idea and realization. Who is in the right position to answer these questions? The M&A consultant? The founder? The customer? Not likely. Broad innovation experience and razor-sharp engineering insight are your best bet.

This is why I would advise any investor or venture manager, interested in a tech company, to involve an innovation partner like Spark. At Spark, we will lift the smoke curtains of wishful thinking and dig deeper into the tech. We will look beyond the report and form our own judgment based on the physical evidence and the raw data. We aim to significantly decrease risks of any investment in technical innovation, by providing insight on feasibility, development roadmap and IP position.

Interested to know more about how we do this at Spark and what you can expect? Then please reach out to us!

As of 2024, Spark is also service partner of the leading Yes!Delft incubator, connected to Delft University of Technology. Here, we provide start-ups inside the ecosystem with advice and network on new product development and production scale-up.

.svg.png)

visible-sustainability-Insight%20hero.avif)